Can Real Estate Booms Hurt Firms? Evidence from Investment Substitution

Journal of Urban Economics, 2024, Vol. 144, 1-23

SFI Research Paper No. 18-38

with Difei Ouyang

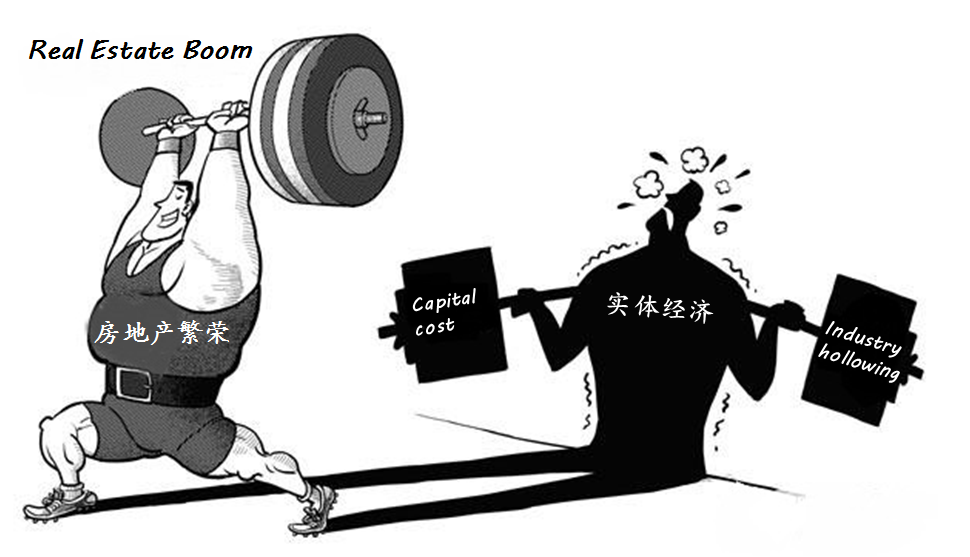

In geographically segmented credit markets, local real estate booms can deteriorate the funding conditions for small manufacturing firms and undermine their growth and competitiveness. Based on exogenous variations in the administrative land supply for residential housing across Chinese cities, we show that real estate price hikes caused by a restrictive land supply reduce bank credit to manufacturing firms, raise their borrowing costs, diminish their investment rate, compromise their output and productivity growth, and increase their exit rates. Such harmful effects are more pronounced among small firms and those located in more bank-dependent regions.

The paper is discussed on the policy website voxeu.org under the title Local capital scarcity and industrial decline caused by China’s real estate booms.

Its research results are also highlighted in the 2022 Summer double issue of The Economist.